Just when I start making progress on any one of these, I wake up in the middle of the night worrying about the others. I haven't been promoting Marina Melee the way I should because I'm researching agents and sending queries for Ye Gods! I'm not querying for Ye Gods! enough because I'm writing Old Putters (and trying to get a short story from Old Putters published). I'm not writing as much as I should on Old Putters because I've started a new marketing push on Marina Melee for Christmas.

AAARRRRRGGGGHHHH!

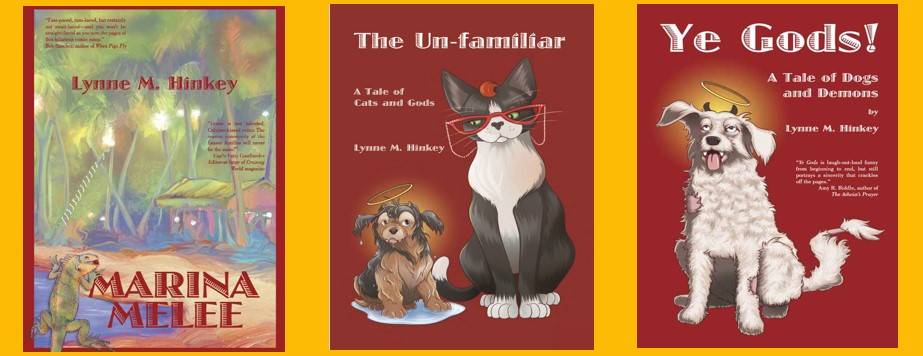

Just when I'm about to throw an all-out hissy fit and give up because I obviously have no talent or ability in writing, marketing, promoting, publishing or anything related to being an author, I get a surprising little boost. About five or six months ago, the encouragement came in the form of encouragement from Hanna, who LOVED Chupacabra when I was ready to give up and rewrite the whole thing. A few weeks ago, the boost came from my editor, Rebecca Bender, who told me not to give up or change the story, and there is an agent out there who will love it, want it, and find a publisher-home for it, and who thinks the new title, Ye Gods!, is better.

The latest bit of encouragement comes from two sources: The Center for Women and West Marine. The Charleston Center for Women holds an Annual Lowcountry Women Authors Book Signing in time for Christmas shopping. I'll be signing copies of Marina Melee. It's on Sunday, December 9th at the Citadel's Holliday Alumni House at 69 Hagood Ave, Charleston.

I made up some of my own fliers to post at marinas and boating supply stores around Charleston. When I stopped by West Marine in West Ashley, the manager, Rob, asked if I'd like to do a book signing there, too! So, I have a signing on Saturday, December 8th (10:00a.m.-2:00 p.m.) at West Marine, too!

|

| West Marine, Savannah Hwy, West Ashley Charleston, SC |